Non-tariff barriers

Non-tariff barriers to trade

Until now, all the trade measures we have analyzed implied changes in the prices faced by consumers or producers. However, governments can also influence trade by means of non-tariff barriers which do not operate on prices. The most common non-tariff barrier are quotas: a physical limit on the amont of goods that a can imported into a country. We shall analyze their effects, show that for the simplest case quotas and import tariffs are equivalent, and then show how more complex market structures affect the equivalency. Since non-tariff barriers tend to be more harmful than tariff barriers, the Uruguay round of the World Trade Organisation recommends the usage of tariff barriers instead of non-tariff barriers. Last, we shall mention some alternative non-tariff barriers that are reguarly employed.

Import quotas

An import quota limits the physical amount of goods that a country can import.

In general, the government allows some local firms to import limited quantities of the good in question, which then they will resell in the local market.

We focus on the simple case of small economy incapable of influencing world prices.

Assuming that, when faced to international prices, Home imports a good $X$, a quota simply limits the quantity that can be imported.

Therefore, the residual demand, this is, the part of Home’s demand not covered by imports will be served by local producers.

Thus, if local demand is $D(p)$ and a quota $Q$ is in place, at world prices $p^w$ demand is $D(p^w)$.

However, only $Q$ can be imported, and the remaining $D(p^w)-Q$ demand is served by local firms.

The relevant equilibrium price $p^\star$ equalises the residual demand with the local supply: firms that obtained the import rights have no interest in selling at a lower price.

Thus, local demand is $D(p^\star)$.

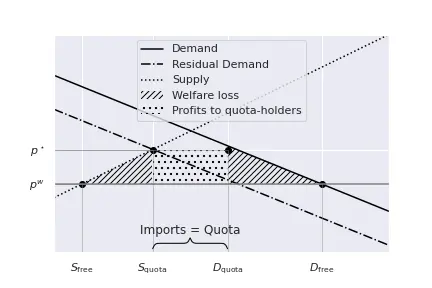

Graphically:

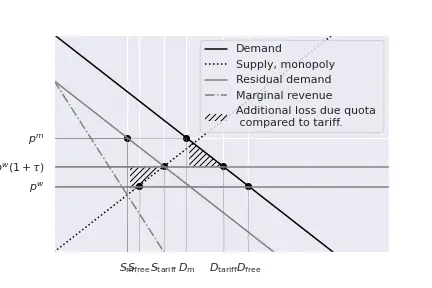

The Figure above does directly represent the total welfare loss (dashed area), where we have already subtracted the benefits that accrue to quota-holders (dotted). The main difference between a quota and tariff is that, with a tariff, the proceedings revert to the government. However, with a quota, firms that import goods cash the difference between the world price ($p^w$) and the local price ($p^\star$).

Considering that, besides a redistribution from the government to quota-holders, the effects of a quota are identical to those of an import tariff, it is no surprise that both instruments are equivalent. This is, given a tariff level, we can compute a quota that will have exactly the same effects, and the reverse. Nevertheless, the analysis changes once we consider dynamics effects and imperfect competition.

Dynamic effects of a quota

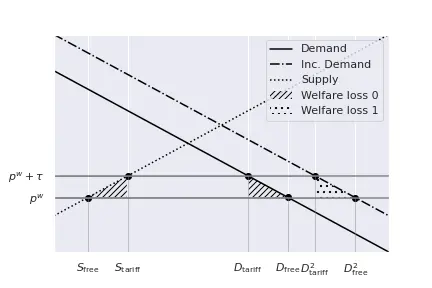

Suppose that, for whatever reason, local demand increases.

In the presence of tariff, very little happens: the world price remains unchanged (small country hypothesis), imports increase because of the rising demand, and the government revenue increases because of higher imports.

If the increase in demand is a parallel shift, welfare losses remain unchanged.

In contrast, a quota limits the quantity that can imported into the country.

Therefore, when demand increases, the residual demand that is left to be served by local producers increases as well: the quota remained the same.

Thus, the local price increases more than before, which further reduces consumers surplus.

As we can see, the additional increase in producers’ surplus does not completely compensate the harm done to consumers, and total welfare declines more than it would with a tariff.

Summarizing, when a small country with an import tariff experinces an expanding demand, the welfare losses do not change. The only thing that changes is that improts increase, together with tariff income. However, with a quota, the local price increases more. Hence, in a dynamic setup, tariffs and quota are no longer equivalent.

- With an increasing demand:

- An import tariff implies more imports and a constant price, with an increase in government revenue.

- An import quota implies constant imports and an increase in prices, with a increase in quota-holders’ rents. Note: quantitive restrictions, like a quota, tend to remain constant over time in developing countries. Consequently, the import limitations becomes more stringent with time, and its pervasive effects more important.

Imperfect competition and import quotas

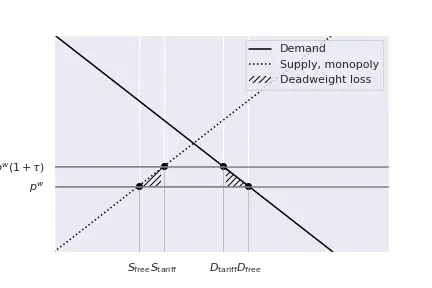

Suppose that the local market is served by a monopoly, Home is a small open economy that imports a good.

Supose also that the government has introduced an import tariff at level $\tau.$

What is the optimal behaviour of the monopolist?

Since there are no restrictions in the number of goods that can be imported, the monopolist is forced by competition to charge a price equal to $p^w(1+\tau).$

Otherwise, if he charged less, he would sell zero as all consumers would turn to imports.

Also, the monopolist has no interest in selling at a price lower than $p^w(1+\tau).$

So, by opening the country to international trade, the monopoly lost it power, and it is forced to operate as if under perfect competition.

Note: in fact, we have Bertrant competition.

Graphically, the situation is the same as for trade with a tariff:

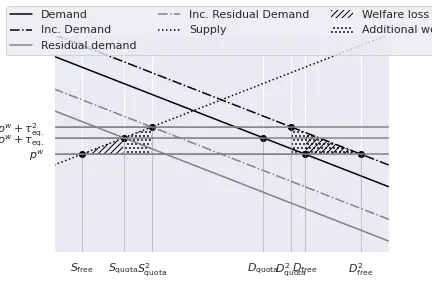

Now, suppose that we introduce a quota that is equivalent to the above tariff.

With the quota in place, things are different.

Since only few goods can enter the country, as determined by the quota, the residual demand will be served by the local producers: the monopoly.

So, the monopoly will maximise its profits equating the marginal revenue to the marginal cost (see your notes from microeconomics).

This implies a price that is higher than under perfect competition, and the quantity supplied is lower.

Lastly, the firms that hold quota rights will sell the imports at the same price as the monopoly: selling above will lead to zero demand, while selling below does not maximize profits.

In graphical terms:

Exercises

Some exercises to practice.